Mountain Review: Nevados de Chillán

MOUNTAIN SCORE #1 in Chile 66 #1 in South America WRITTEN REVIEW VIDEO REVIEW MOUNTAIN STATS CATEGORY BREAKDOWN See our criteria 8 Snow: 5 Resiliency: 6 Size: 8 Terrain Diversity: 8 Challenge: 3 Lifts: 7 Crowd Flow: 6 Facilities: 6 Navigation: 9 Mountain […]

Mountain

Pholiage Report

As autumn moves forward, the three mountains at Smuggs are beginning to reveal a life beyond a dream. The canopy that once felt endless and uniform is now alive with ruby waves of maple, birch, and beech, creating a divided sky between the deep blue […]

ViewsMost Shocking Things About Skiing in Australia

Skiing in Australia is decidedly exotic, although it does have its drawbacks. Background When it comes to a trip to Australia, the first thing that comes to mind is probably the Outback (and maybe an exotic array of animals). But a surprising thing […]

Mountain

Stretch and Go!

Conditions & Atmosphere Weather: Widespread haze before 8 am. Sunny, with a high near 81. Northwest wind 6 to 9 mph. Vibes: Summer weather at its finest at Smuggs today. There will be a little haze that will burn off, and then the sun will be shining, […]

ViewsConditions & Atmosphere

- Weather: Widespread haze before 8 am. Sunny, with a high near 81. Northwest wind 6 to 9 mph.

- Vibes: Summer weather at its finest at Smuggs today. There will be a little haze that will burn off, and then the sun will be shining, allowing you to really open up that playbook. Dial up a deep post route, take the long shot, and make today a touchdown.

Today’s Highlights

- Activities:

- Stretch & Go. 8:00 am, and 10:00 am. Ages 15 & older. Gazebo on the village green.

- Smuggs I-Did-A-Cart. 10:30 am, and 1:00 pm. All ages. Adventure Tent.

- Special Event: Smuggs Backyard Bash and BBQ. 5:00 pm. All ages. Village Green. Lawn Games, Music, Magic, Tie-Dye. Food and Drinks, S’mores kits.

Looking Ahead

- Jeffersonville Farmers’ Market. Wednesday, July 30, 4:00 pm – 7:00 pm.

The Farmers’ and Artisan Market unites our community’s producers, musicians, and neighbors with weekly live music. Enjoy the freshest local foods and more. You can find our summer market at 49 Old Main Street, in the field at the Route 15 & 108 South roundabout intersection. Please access parking at the silo space and the field off Old Main Street.

https://www.jeffersonvillefarmmarket.com

- Line Dancing. Wednesday, July 30, 6:00 pm – 9:00 pm.

Join Better In Boots at the Boyden Valley Barn every other Wednesday night from 6:00 pm – 9:00 pm starting June 18th, ALL SUMMER LONG! Come out for a fun, welcoming night of line dancing, great food, and local brews! Whether you’re brand new or have a few dances under your belt, there’s something for everyone. We’ll teach a new dance each week, most around 32 counts, though the speed and difficulty may vary. After the lesson, stick around for open dancing and song requests to close out the night.

- Schedule:

6:00 pm – Open dancing & warm-ups

6:15 pm – Lesson begins and continues through roughly 7:30 pm - Followed by open dancing & requests until 9:00 pm

- Beginner-Friendly!

No experience required—we’ll teach you everything you need to know! - A Few Quick FAQs:

Purchase tickets to reserve your spot or pay Cash at the door! Do I need boots? Nope! Wear whatever is comfortable. Is this couples dancing? No, this is single line dancing—though you’re welcome to turn it into a partner dance if you like. Hydration reminder: This is exercise! Please stay hydrated. The bar will be open for drinks and you can bring your own water! Clean shoes, please! If your shoes are muddy, bring a clean pair to change into for the dance floor. Do I need to know how to line dance? Absolutely not—that’s what I’m here for!

Can’t wait to see you there! Let’s dance!

https://www.smuggs.com/event/line-dancing/2025-07-30/

Text Smuggs to 855-421-2279 for real-time alerts about weather updates, schedule changes, and more!

Text Smuggs to 855-421-2279 for real-time alerts about weather updates, schedule changes, and more!

The post Stretch and Go! appeared first on Smugglers’ Notch Resort Vermont.

Friendly Friday

Conditions & Atmosphere Weather: Showers, with thunderstorms also possible after 2:00 pm. High near 77. Southwest wind around 7 mph, becoming northwest in the afternoon. The chance of precipitation is 80%. Vibes: It can’t always be sunny, right? After four straight beauties, today looks to be a […]

ViewsConditions & Atmosphere

- Weather: Showers, with thunderstorms also possible after 2:00 pm. High near 77. Southwest wind around 7 mph, becoming northwest in the afternoon. The chance of precipitation is 80%.

- Vibes: It can’t always be sunny, right? After four straight beauties, today looks to be a bit gray and wet. Don’t fret, the weekend is lining up to be lovely, so our jackets and umbrellas will only be a temporary necessity.

Today’s Highlights

- Activity:

- Llama Treks 10:30 am – 1:00 pm. All ages. Village Recreation Area.

- Disc Golf Challenge 8:00 pm – 9:00 pm. All ages. Village Green.

- Event: An evening with Rockin’ Ron the Friendly Pirate. First, it’s the family sing-along from 4:30 pm – 5:00 pm, then we have Bingo from 5:00 pm – 5:45 pm, and concluding with Capture the Flag from 6:00 pm – 7:00 pm. Everything takes place out on the Village Green. You might think Ron’s favorite letter is “R”, but it’s the “C.”

Looking Ahead

- Annual Jig in the Valley July 27, 12:00 noon – 8:00 pm.

Join us on the green in East Fairfield, rain or shine, for a day of great music, fabulous homemade food and desserts, kid’s activities, 50/50 raffles, a flea market, a silent auction, and so much more… Dale and Darcy, The Missisquoi River Band, Rusty Bucket, The Nobby Reed Project, The Oleo Romeo’s Big Variety Show, and Christine & The Beautiful People are among the musicians slated to perform. Ticket prices collected at the event entrance are $10 per person or $25 for a family! Bring your blanket, lawn chair, dancing shoes, and well-behaved dogs (on a leash, please) for the biggest annual event and fundraiser for The Fairfield Community Center, celebrating summer, our community, and life itself!

Text Smuggs to 855-421-2279 for real-time alerts about weather updates, schedule changes, and more!

Text Smuggs to 855-421-2279 for real-time alerts about weather updates, schedule changes, and more!

The post Friendly Friday appeared first on Smugglers’ Notch Resort Vermont.

Trail Talk: Mapping the Notch

While the lifts may be quiet and the trails green, things are far from sleepy up on the mountain. Our Mountain Ops team has been busy with the usual summer maintenance—tuning equipment, inspecting lift lines, and keeping everything in top shape behind the scenes. But […]

ViewsWhile the lifts may be quiet and the trails green, things are far from sleepy up on the mountain. Our Mountain Ops team has been busy with the usual summer maintenance—tuning equipment, inspecting lift lines, and keeping everything in top shape behind the scenes. But there’s one big project we’re especially excited about this season: our ongoing work with the Snowright System.

This summer, we’ve spent a ton of time trail mapping—creating a detailed digital baseline of the mountain’s natural terrain. Why does that matter? Well, it helps us know exactly how much snow we need to make to fill every dip, knoll, and corner on each trail, instead of relying on estimates. Not only will this lead to better coverage and longer-lasting snow, but it also means we can be smarter and more efficient with both water and energy—big wins all around.

The Snowright System will integrate with our snowmaking software to monitor the amount of water pumped on the hill, and it pairs with the technology in our groomers to measure snow depth in real-time. In short, it’s a precision snowmaking tool that’s going to help us make just the right amount of snow, right where it’s needed.

Oh—and speaking of grooming, we’ve got a brand-new snowcat arriving this fall, just in time to roll into the season with fresh treads and an even smoother ride.

We’ll keep you posted as more improvements roll out, but for now, just know your favorite trails are getting a little smarter this summer. Got questions about the snowmaking system or other behind-the-scenes updates? Let us know in the comments!

And while you’re waiting for flakes to fly, a quick shoutout to our longtime mountain messenger: Hugh Johnson recently received the NASJA Bob Gillen Award for his contributions to snowsports journalism—well deserved! He’ll be back sharing updates and snow stoke in just a few short months.

Stay cool, and keep dreaming of first tracks!

The post Trail Talk: Mapping the Notch appeared first on Smugglers’ Notch Resort Vermont.

Mountain Collective Adds Whiteface, New York for 2025-26 Season

Whiteface becomes the third U.S. Northeast resort to join the Collective, which has retained a western-heavy portfolio in recent years but has made serious strides towards rectifying that. New York’s Whiteface will join the Mountain Collective Pass for the upcoming 2025-26 season, according […]

Mountain

Whiteface becomes the third U.S. Northeast resort to join the Collective, which has retained a western-heavy portfolio in recent years but has made serious strides towards rectifying that.

New York’s Whiteface will join the Mountain Collective Pass for the upcoming 2025-26 season, according to New York State’s ORDA. At 288 acres with a 3,430-foot top-to-bottom footprint, Whiteface is home to the longest vertical drop in the Northeast. Collective Pass holders will get two days of unrestricted access at Whiteface next winter, as well as all other mountains on the pass.

Whiteface becomes the fifth Northeast ski resort on the Collective for 2025-26, joining Maine’s Sugarloaf and Sunday River and Quebec’s Bromont and Le Massif de Charlevoix. For the upcoming winter, Mountain Collective will now offer two-day access to 27 destinations around the globe, 20 of which are in North America (Arapahoe Basin has left the pass for 2025-26).

Notably, Whiteface becomes the first-ever Mountain Collective partner in New York. This also marks the first time Whiteface has joined a multi-mountain pass (besides ORDA’s Ski3 pass) since the dissolution of the MAX pass in 2018.

Our Take

The Mountain Collective Pass has struggled to establish a strong presence in the Northeast, especially after losing Sugarbush a few years ago. Until recently, the pass included only two Northeast mountains—Le Massif and Sugarloaf—leaving it with no representation in Vermont and offering limited appeal for skiers and riders based in New York or the surrounding areas. While last year’s additions of Sunday River and Bromont helped a little bit, the pass’s primary competitors—Epic, Ikon, and Indy—each maintain a far more robust presence in the region.

Adding Whiteface aims to help change that. Though the mountain isn’t perfect—it’s known for its wind-exposed layout and occasional resiliency issues—the move restores a competitive destination to the East Coast within reasonable driving distance of New York City. It probably still isn’t enough to make the pass a viable alternative to Epic or Ikon’s base options in the Northeast, but Mountain Collective is now a bit more versatile for East Coast skiers, especially those within reach of the Adirondacks.

Considering the Mountain Collective Pass? Check out our detailed comparison against competing Epic, Ikon, and Indy offerings. You can also check this comparison out in video form below.

Mountain Review: Mount Bohemia

MOUNTAIN SCORE Lac La Belle, MI 48 #113 Overall WRITTEN REVIEW MOUNTAIN STATS VIDEO REVIEW CATEGORY BREAKDOWN See our criteria 6 Snow: 2 Resiliency: 3 Size: 4 Terrain Diversity: 8 Challenge: 2 Lifts: 7 Crowd Flow: 3 Facilities: 6 Navigation: 7 Mountain Aesthetic: […]

MountainMOUNTAIN SCORE

Lac La Belle, MI

48

CATEGORY BREAKDOWN

6

Snow:

2

Resiliency:

3

Size:

4

Terrain Diversity:

8

Challenge:

2

Lifts:

7

Crowd Flow:

3

Facilities:

6

Navigation:

7

Mountain Aesthetic:

GOOD TO KNOW

1-Day Ticket: $95

Pass Affiliation: None (some partner resorts on season pass)

On-site Lodging: Limited

Après-Ski: Moderate

Nearest Cities: Green Bay (4.5 hrs), Milwaukee (6.5 hrs), Minneapolis (7 hrs)

Recommended Ability Level:

+ Pros

-

Consistent lake effect snow

-

Easy to find advanced and extreme terrain

-

Unique views and vibe

-

Insanely cheap season pass

– Cons

-

Incredibly inconsistent openings and snow quality

-

Slow lifts, along with bus rides for some runs

-

No beginner runs and limited intermediate runs

-

Far away from everything

MOUNTAIN STATS

Skiable Footprint: 415 acres

Total Footprint: 585 acres

Lift-Serviced Terrain: 100%

Top Elevation: 1,460 ft

Vertical Drop: 823 ft

Lifts: 2

Trails: 95

Beginner: 0%

Intermediate: 4%

Advanced/Expert: 96%

VIDEO

Mountain Review

Looking for one of the most unique skiing experiences in the country? Look no further than… Michigan? Located almost 10 hours from Detroit at the tip of the Keweenaw Peninsula, Mount Bohemia, or “Boho” offers a no frills ski area that claims to be for advanced skiers and riders only. But does “best in the Midwest” translate to best in the country?

Even on somewhat sunny days, weather can change fast as the Lake Effect Snow moves in, making for constant powder days.

Snowfall and Resiliency

Despite being in the Midwest, Boho offers snowfall far above its competition. Unlike competing ski areas, many of which would be lucky to see high double digits of snowfall inches each year, Boho regularly sees hundreds of inches of snow annually. This is in large part thanks to generous lake effect snowfall (LES), as Lake Superior surrounds the ski area from nearly every direction, with the sole exception being the immediate southwest. Whenever the lake isn’t frozen over and the wind is blowing, you can bet your bottom dollar it’s snowing in the Keweenaw. This means that there are less deep powder days, but very consistent 2”-8” days. After larger parts of the lake freeze over, which is usually in late February-March, the area is generally colder and gets less snowfall due to the lack of LES. In the best years, seasons can extend as far as May 1st, which is especially impressive given Boho’s complete lack of snowmaking.

But that lack of snowmaking and dependence on mother nature is a cruel double edged sword. With much of the footprint south and west facing, the snow melts off quickly in the springtime, and can get very icy after multiple days without any snow. Unlike other Midwest ski areas that can get around icy slopes with top notch grooming, Boho lacks grooming entirely. This means if it’s been a week, or even a few days without snow, the whole area will have turned into icy bumps and icy glades. In the later springtime, the small minority of north facing slopes stay open longest, though this area isn’t immune from ice either. Mount Bohemia’s lack of resiliency measures especially have consequences for its early season. Sometimes, the ski area doesn’t open until late January, and a February opening isn’t entirely unprecedented either. Neither are mid-season closures in the event of especially awful natural conditions. Wind holds are also sometimes an issue, as the wind off the lake can close the lifts for the day; that being said, under these circumstances, the hill will still be open to those who want to earn their turns by hiking or skinning up. Luckily, pending an absolutely terrible season, the snow in midseason tends to be very consistent, and due to the isolation of the hill, there are stashes of snow that can stay for days, or even weeks at a time if you can find them and the weather has remained cold.

Mount Bohemia is home to two brightly colored fixed-grip lifts, which both deal with lines quite well on all but the busiest days.

Lifts and Buses

As for getting up the hill, there are two lifts, the frontside triple chairlift (officially known as the Mountain Dew Hoist), and the backside double lift (officially known as the Honey Pot Hoist). The triple lift is in the process of a phased rebuild, and the project will bring new towers and triple chairs for the 2025-26 ski season. Despite there only being two lower capacity lifts, lines at Mount Bohemia move relatively fast, with occasional 15 minute lines building up on the busiest Saturdays, but ski-on lifts on weekdays.

A significant number of runs also end at the road, where a group of shuttle buses run every day to bring people back to the main base. This bus system runs frequently and efficiently, making the lack of ski-out access less of an annoyance than one might think. It is worth noting that on busy days, you may experience a few buses passing you by while you wait along the road after they fill up earlier on the route. If you want to get first dibs on a bus seat, runs that go the furthest east, like those in the Far East or Middle Earth areas, end where the bus routes start, so you’re almost guaranteed a seat when skiing those runs. Runs that end further west, like the Extreme Backcountry terrain, are later in the bus route, meaning you could be waiting as a few buses pass you by in that area.

The buses themselves are pretty interesting as well, with different buses having different music themes. If you find yourself on the ABBA bus, you might even find yourself witnessing live performances of ABBA songs.

TRAIL MAP

Navigation and Layout

When it comes to finding your way around the mountain, you may be a bit confused your first time at Mount Bohemia. Boho has a very unique vibe in that the run names don’t matter too much, and getting lost is often a part of the experience. The trail map is also quite unhelpful, though some different maps at the base area can help clarify some navigation, though these maps are a little out of date and a few runs have been added that aren’t shown on the map. That being said, you will always end up either at a lift or the road to ride one of the aforementioned buses, so it’s tough to be in a position where you can’t get home at the end of the day. Since the buses on the road go right back to the base, you’re never more than a lift or bus ride from there.

When it comes to Mount Bohemia’s layout, the resort can effectively be thought of as a cone. From the summit, terrain goes down from every side of the mountain. The mountain is made up of the frontside lift lappable terrain (Bohemia Mining Company and Bohemia Bluffs on the map), the backside lift lappable terrain (Bears Den on the map), the north side (Haunted Valley, Outback, Pirates Cove, and Graveyard), the east side (Outer Limits and Middle Earth), and last but not least, the Extreme Backcountry, which is between the frontside and backside terrain. Each of these terrain zones has something different to offer, with cut mogul runs on the frontside, long undulating cut runs on the backside, shorter and steeper glade runs on the north side, long stretches of woods to get lost in on the east side, and plenty of steep trees and cliff drops in the Extreme Backcountry. Just about all the trees throughout the 400-acre area are skiable, though it’s important to stay alert for unmarked rocks and cliffs, which can pop up just about anywhere on the mountain. The tree runs vary widely, from wider cut runs through Oaks and Maples on the frontside and Haunted Valley, narrower runs through cedar and hemlocks in Middle Earth, steeper runs through old growth pines in the Extreme Backcountry, and other mixes of trees, tightness, and steepness throughout the area.

Beginner Terrain

If you’re not a confident skier or rider, it’s probably wise to think twice before booking a trip to Mount Bohemia. Beginner terrain doesn’t exist at all at Boho, which the mountain makes abundantly clear with its “No Beginners Allowed” marketing materials. With no groomed runs, the snow is either bumped up or rutted out in higher traffic areas, making the whole mountain not ideal for learning to ski or snowboard.

Intermediate Terrain

Intermediate terrain is limited as well. The resort has two marked blue runs, though one of them, the Ghost Trail, is a long catwalk—and it also happens to be the easiest way down from the summit. If you’re an intermediate skier looking for easier tree terrain, the Far East and Middle Earth glades are a lot more mellow, with meandering runs following small streams and gullies. Some of the Bear’s Den terrain is also doable by intermediate skiers, though it will likely be bumped up short of an exceptional powder day. The frontside cut runs also have mellower slopes, but they are typically home to the largest moguls. Although the Prospector blue run does exist on the front side, some marked black diamond runs are actually easier due to its steep entrance. If you can’t ski bumps or trees, Boho is not for you.

While some of Boho’s glades start out unassuming, unmarked obstacles such as stumps, rocks, and cliffs can pop up anywhere across the mountain.

Advanced and Expert Terrain

To really appreciate Mount Bohemia, you should really be at an advanced or higher level of skiing or riding. All the terrain marked with a single or double-black diamond should be doable for guests of this skill level. This all being said, if you are unfamiliar with the mountain, heed caution when in double-black gladed runs; unmarked obstacles such as stumps, logs, rocks, and even cliffs tend to pop up in these areas.

For the biggest challenges at Mount Bohemia, guests will want to head to the Extreme Backcountry area. Here, all the runs are marked with the notorious triple black diamond rating. Many people will scoff at that ostentatious symbol, but it really isn’t much of an exaggeration as far as they go, as the area is bisected by a cliff line halfway down the runs. The center of the cliff band is where the largest drops are, where cliffs as tall as 40’ can be found. Even if you drop the cliffs, the hardest part is yet to come, as the landings are usually in very tight trees. Other than the cliffs, the Extreme Backcountry holds many steep glades with scattered rocks, logs, and stumps that make for some very playful terrain among the pine trees. There are a few other triple black diamonds scattered across the mountain that hold other extreme features such as cliffs from 10-30 ft tall.

With a vertical rise of almost 850 ft, Mt Bohemia is a bit of an anthill on the national stage, although regionally, this is actually competitive enough to give it the largest vertical drop in the Midwest (If you exclude the Black Hills of South Dakota). This means that while Boho has steep runs, they aren’t the longest if you’re used to skiing outside the Midwest. If you’re looking for real cardio runs in your next destination ski trip, you may be a little disappointed with the experience. However, since both lifts are top to bottom, you will be skiing for the whole vertical in every run, rather than skiing smaller pods. For example, the vertical of Bohemia is taller than lifts such as Powder Seeker 6 at Big Sky, Mott Canyon at Heavenly, or Shooting Star at Stratton.

Mount Bohemia boasts views of not only the nearby Lac La Belle, but also the massive Lake Superior in the distance and endless forests all around.

Mountain Aesthetic

On a clear day, the aesthetic at Mount Bohemia impresses. From the top of the hill, you have an expansive view of the Keweenaw Peninsula, many lakes, and the massive Lake Superior. You can see as much as 50 miles out across the lake, including down to the Huron Mountains to the south, and Isle Royale to the northeast. While trees prevent the view from the summit from being truly 360 degrees, there are many areas across the mountain that have clear views of the big lake, or the smaller Lac La Belle. If you’re searching for an isolated skiing experience, you’ll surely find that at Boho, as many runs will find you feeling lost in the woods before popping out on a cut run or at the road. This all being said, the big downside to the views at Boho is the limited number of clear days, as the Lake Effect snow can bring cloudy conditions, even on days when it’s sunny further from the lake.

Little Boho and Voodoo Mountain

For those seeking a novel experience, it’s also worth noting that Mount Bohemia offers “Little Boho,” a distinct ski area accessible via a short hike from the back of the main parking lot. The hike or skin up to this 300-vertical-foot area takes 15 to 30 minutes depending on your level of fitness and is generally flat. The runs end with bus service required to get out (which is less frequent than that of the rest of Mount Bohemia). But this jaunt can pay off, as Little Boho is home to some properly steep terrain—and it stays untracked if it’s been a few days since the last snowstorm and temperatures stay consistent. Little Boho has a more fickle opening schedule than the rest of the resort, and under most circumstances, it’s probably not worth the hike, but it’s there if you want some extra terrain to check out with pretty much nobody on it.

While not physically connected to Mount Bohemia, there is also a cat skiing operation run out of Boho called Voodoo Mountain. This full-day experience runs on Wednesdays and Saturdays on some hills north of Mount Bohemia proper and costs less than $200. This is also held on north-facing terrain, and thanks to the limited number of people, powder stays untracked for weeks, though the terrain is much less steep than the runs found at Mount Bohemia. While not for everyone, this is one of the cheapest full-day cat skiing operations in the country, and allows for plenty of mellow powder turns.

RECOMMENDED SKIS FOR MOUNT BOHEMIA

NOTE: We may receive a small affiliate commission if you click on the below links. All products listed below are unisex.

Recommended intermediate ski

Recommended advanced ski

Recommended glade ski

Recommended powder ski

Mount Bohemia’s yurt-heaving base area is home to a few bars, lodging, and food options.

Getting There and Parking

In order to get to Mount Bohemia, you need to be prepared for quite the journey. The nearest airport is in Hancock, around an hour away, and flights only go to and from Chicago, and are susceptible to getting cancelled due to weather. The nearest larger airports are in Green Bay (4.5 hours away), Milwaukee (6.5 hours away), Minneapolis (7 hours away), or Chicago (7.5 hours away). The drive can also get hairy at times due to weather, and visibility can drop to near zero at any time. In general, weather forecasts are not as accurate in the Keweenaw Peninsula due to the microclimate, so be prepared for anything.

RECOMMENDED SNOWBOARDS FOR MOUNT BOHEMIA

NOTE: We may receive a small affiliate commission if you click on the below links. All products listed below are unisex.

Recommended intermediate board

Recommended advanced board

Recommended expert board

Recommended powder board

Après-Ski and Lodging

When it comes to things to do at Mount Bohemia besides skiing and riding, boy is it an experience. Directly off the ski runs are two bars (one of which is Christmas themed year round), two areas to get food at prices that are expensive for the Midwest, but reasonable by ski area standards, multiple options for lodging, and the Nordic Spa. The spa is included with a season pass and offers multiple saunas, a cold plunge, a steam room, an outdoor pool, and the largest hot tub in the Upper Peninsula. The hot tub has gotten so popular that oftentimes they have to have mandatory rotations on weekends. For lodging, you can rent slopeside cabins or yurts for groups, or stay in the hostel on site, but these accommodations are sparing in amenities. If you want to stay somewhere a bit nicer, a few inns and vacation homes do exist around the peninsula, but they’re either sparse in quantity or over half an hour away. If you have an RV or camping set up, you can also grab a spot in the parking lot along with some locals who stay there all season, though if your camping setup is more conspicuous, you should probably reserve a space for $25.

Boho’s “Nordic Spa” is home to some large hot tubs, saunas, and cold plunge pools, and becomes a popular Après spot after the slopes close down.

Verdict

Overall, Mount Bohemia is one of the most unique destinations for skiing and riding on the Continent. The mix of advanced and expert terrain at such an unassuming location with one of the most unique après scenes in the US makes any trip to Mount Bohemia a memorable experience. And on a clear day, the lake views don’t hurt the experience either.

Pricing

For pricing, 1-day tickets start at $95, and you can’t buy day tickets for Saturdays. Tickets are only sold online, but this is one ski area where it is expected you don’t buy a day ticket, as the season pass is one of the best deals in the country. For $109 (plus fees) you get a full season pass to Mount Bohemia, including the Nordic Spa, and a large, nationwide reciprocal network. This reciprocal network does have some caveats, so make sure to check the Mount Bohemia website before you redeem these benefits. The pass is only on sale for one week in December, and if you miss it, you’re out of luck. If you are even thinking of skiing at Mount Bohemia, buy the season pass when it is on sale.

A Draft Bill May Permanently Damage U.S. Skiing. Here’s How We Can Stop It.

Over 100 American ski resorts are at risk of having their lands sold under a draft U.S. Senate bill. A draft bill in the U.S. Senate has ignited national debate, calling for the sale of as many as 3.3 million acres of public […]

Mountain

Over 100 American ski resorts are at risk of having their lands sold under a draft U.S. Senate bill.

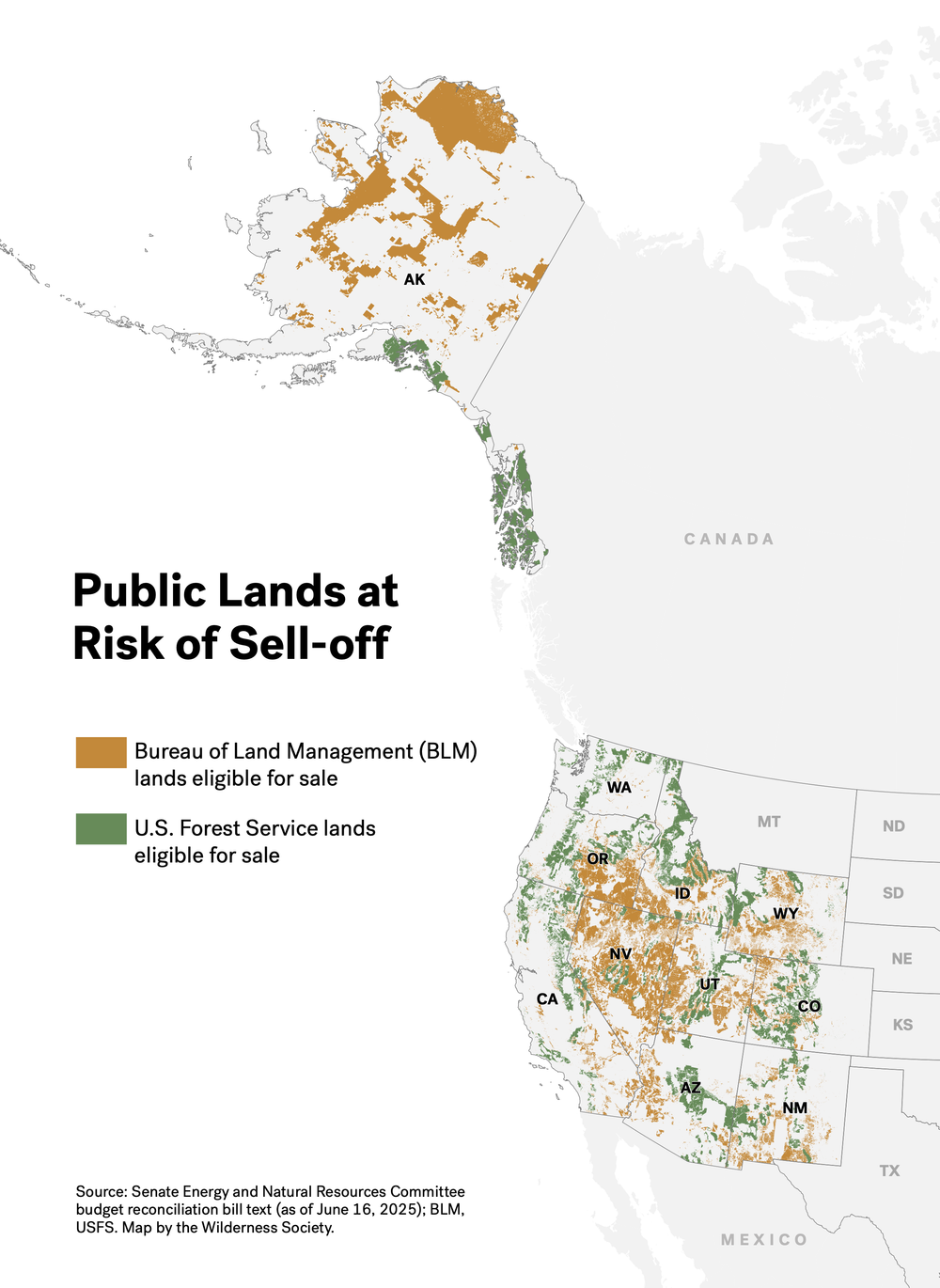

A draft bill in the U.S. Senate has ignited national debate, calling for the sale of as many as 3.3 million acres of public lands administered by the Bureau of Land Management (BLM) and U.S. Forest Service. While it’s framed as a fiscally responsible measure to reduce the federal deficit and ease the housing crisis, the proposal has drawn criticism from environmentalists, recreation advocates, and even outdoor industry executives.

Proponents say we won’t notice much and that the impacted areas are paltry compared to the nation’s total public land footprint, but others see it as the start of a dangerous precedent that could permanently alter America’s outdoor recreation economy—including its ski industry.

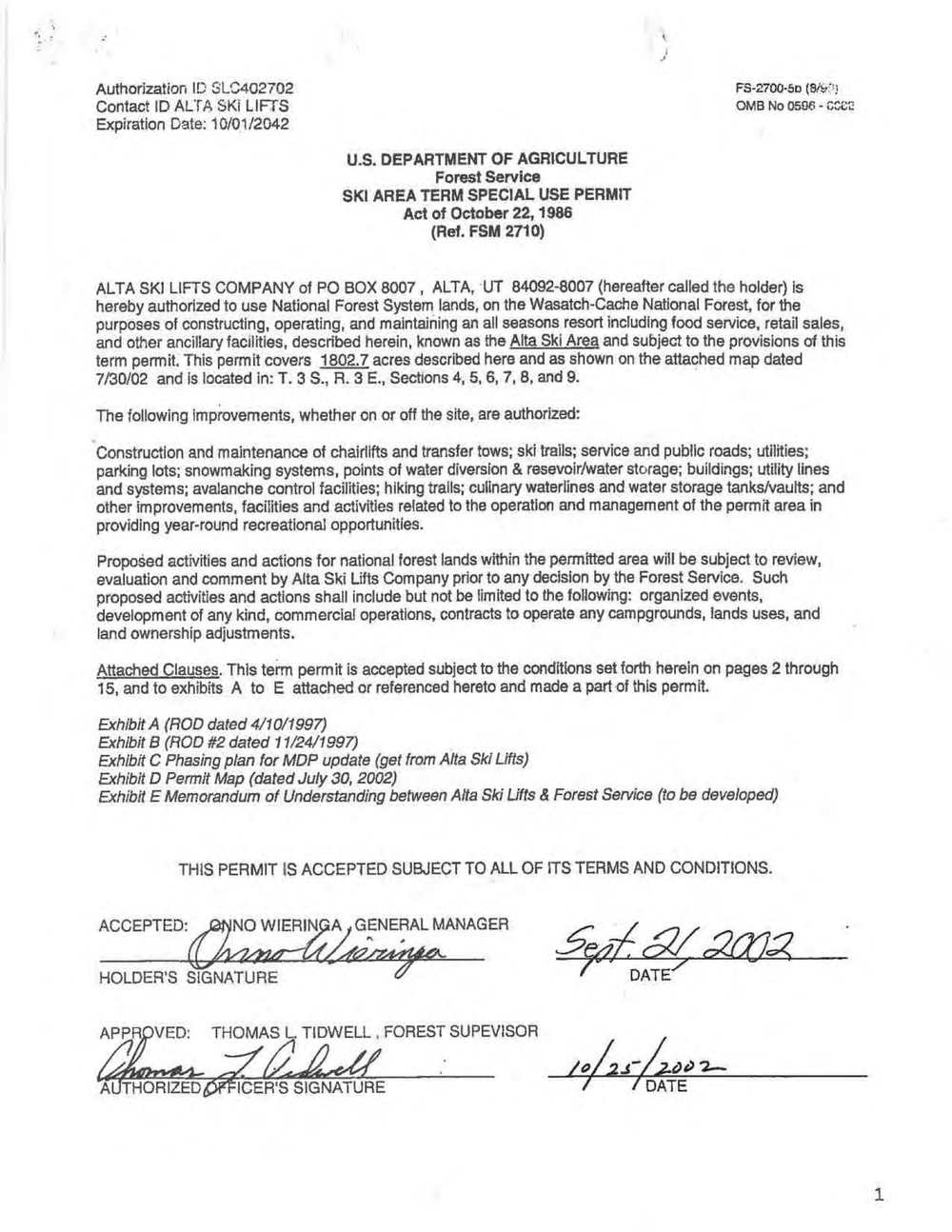

Special Use Permits (SUPs) have allowed ski resorts such as Alta (pictured above) to operate on public land for nearly a century.

Historical Context: How Public Lands Shaped Skiing

Before getting into the impacts of this bill, it’s important to understand how we got to so much publicly-owned ski resort land in the first place. The partnership between the U.S. Forest Service and ski resorts didn’t happen by accident—it was the result of a deliberate policy shift after World War II. In the late 1940s, the U.S. Forest Service shifted from a purely industrial to a more recreational focus, and it began issuing Special Use Permits (SUPs) to operators who wanted to build lifts, lodges, and trail systems on federal land. Under these permits, ski resorts would pay the federal government a portion of their revenue in exchange for access to operate on national forest land. But the government retained ownership of the land and set conditions on how it could be used, including environmental protections, seasonal closures, and public access guarantees like uphill skinning routes and backcountry trailheads.

This arrangement was seen as a win-win: local economies would benefit from tourism dollars, private operators would assume the risk and costs of development, and the federal government would retain ownership and regulatory authority over the land. The United States saw a huge boom in these partnerships that lasted through the early 1970s, and resorts like Aspen, Breckenridge, Heavenly, and Mount Hood Meadows owe their very existence to the availability of public lands. Today, over 100 American ski areas operate partially or fully on publicly-owned lands, including the vast majority of destination ski resorts that most people visit.

What the Bill Actually Proposes

If the U.S. Senate bill is passed with its present language, about 0.5-0.75% of the lands highlighted above are at risk of being sold off.

So what exactly is at stake in the recent budget proposal? The bill in front of the U.S. Senate, referred to colloquially as the “Big Beautiful Bill”, mandates the sale of between 2.2 and 3.3 million acres of public lands managed by the Bureau of Land Management (BLM) and U.S. Forest Service over the next five years, encompassing roughly 0.5-0.75% of their total holdings. These lands are spread across 11 Western states: Alaska, Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Utah, Washington, and Wyoming—with a notable carve-out in Montana, secured by Senator Steve Daines’s opposition. It is worth noting that certain high-profile public lands are excluded from sale eligibility, including national parks, national monuments, wildlife refuges, and parcels with existing grazing rights. Despite the headline figure of surplus land being considered to sell off, it’s worth noting that the final 3 million or so acres will come from a much broader pool of eligible land that spans over 250 million acres.

If and when the bill is passed, these land sales will happen incredibly fast. Within 30 days of enactment, federal agencies must begin nominating parcels for sale, and they must publish new lists every 60 days until the acreage goal is met. Crucially, this process bypasses environmental review, public hearings, and direct community input. Although the bill includes a “tiered sale” structure giving state and local governments, as well as tribes, a right of first refusal, critics note that tribal access is not guaranteed and could be effectively sidelined. Meanwhile, 90% of the revenue generated from sales would go to the U.S. Treasury, with 5% allocated to the selling agency for maintenance backlogs and another 5% designated for local infrastructure.

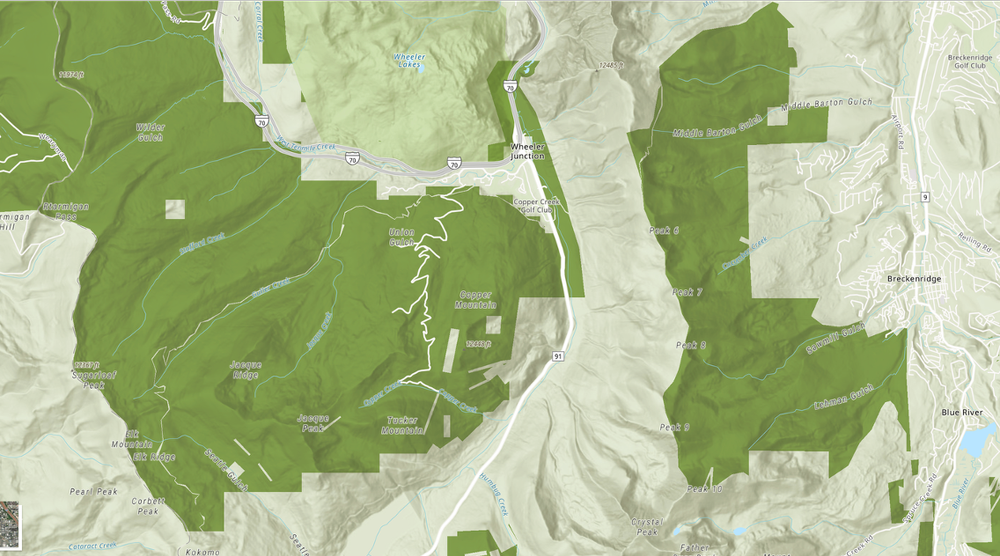

So why these particular areas? The bill frames the sales as targeting “underutilized” federal lands near growing population centers to help ease housing shortages. On paper, this may not sound like the worst reasoning in the world; since development is so restricted on these lands, one could argue they artificially inhibit growth in some towns and small cities. However, independent analysis has found that only a small fraction—less than 2% of BLM and Forest Service lands—are realistically suitable for this type of development, with many of them too far from developed areas or too ecologically sensitive to be practical. And perhaps one of the biggest examples of this is ski resorts—according to research conducted by the Wilderness Society, essentially every destination ski area that’s not entirely privately owned, including Copper, Breckenridge, Vail, Aspen Snowmass, Alta, Snowbird, and Mammoth, among others, sits in part or fully in the eligible for sale area.

But it’s not just the quantity of potential land that’s raising concerns—it’s also the process under which it could be gone. On top of the speed and lack of environmental oversight that we discussed earlier, critics argue the bill sets up a no‑review, rapid‑sale mechanism that allows political and corporate interests to nominate and purchase public lands with minimal vetting. This risks irreversibly converting valuable recreation landscapes and sensitive ecosystems, including many of the ski resorts that we know and love, into private developments through a hasty and unpredictable process.

The public land underneath ski resorts such as Breckenridge and Copper (both pictured above) could be eligible for sale if this bill passes.

What Happens if Ski Resorts Own the Land?

So what happens if ski resort land happens to be sold as part of this initiative? One scenario would be resorts themselves purchasing the public BLM or Forest Service land they operate on. On the surface, this may not seem like the biggest deal—after all, these mountains already use this land on a daily basis—but in practice, the implications would be dramatic. This shift would release ski resorts from the restrictions of their Special Use Permits, meaning they could expand terrain, build lifts, or develop new infrastructure without undergoing the current rigorous environmental review process or needing to allow public comment. Notably, state and local agencies could still have some regulatory agency, and certain environmental restrictions like the Clean Water Act would still need to be followed.

Now, this circumstance wouldn’t exclusively be a bad thing: we could see shorter timelines for infrastructure improvements, additional nearby bar and restaurant opportunities, and potentially more ski-in/ski-out or close-by residential accommodations. Theoretically, new ski resorts could be a possibility as well, although it would take decades and extraordinary capital investment to make these resorts competitive with the destinations, so we think this is unlikely.

However, it’s also easy to envision situations where things go haywire. We could see the public resorts become closer in aesthetic to privately-owned ones like Big Sky and Deer Valley, with more condos and development across what should ideally be an isolated footprint. Access policies could also see significant revisions—resorts would no longer be obligated to permit uphill skiing routes or backcountry access through their terrain, and they could impose outright bans or introduce new fees at will. Under the worst case scenario, resorts could use this newfound autonomy to go fully or semi-private. We could see what’s already happened at Powder Mountain in Utah, a resort that recently closed off a substantial percentage of its terrain but all but private homeowners, or we could theoretically see mountains following in the footsteps of resorts like Yellowstone Club and Wasatch Peaks Ranch, which are completely private to those who don’t own land. Finally, we could see some resorts spend more money than they could afford to in order to purchase the land beneath them—perhaps in some cases to avoid a hostile takeover. In doing so, they could be using up cash that would have otherwise been spent on infrastructural or capital investments, consequently leading to a stagnation in resort improvements, and ironically turning some regulatory constraints on development into financial ones. Wouldn’t it be crazy to see Vail Resorts buying Alterra’s land or the opposite way around? Well, if this bill goes through, that’s not overly far-fetched anymore.

If ski resorts buy their own land, we could see faster capital improvement timelines. But we could also see parts or all of these mountains close to the public like what’s currently happening at Powder Mountain (pictured above).

What Happens if Ski Resorts Don’t Own the Land?

But this brings up an interesting point—what happens if the resorts see their land go private, but they don’t own it? If third-party private buyers acquire land adjacent to or even beneath resort terrain, they could wield enormous leverage. The biggest worries would probably be for smaller, more local ski areas without the resources to bid for the land at a price the government would find attractive. There are dozens of smaller, independently-owned resorts that could be affected by this, but a few higher-profile examples include Monarch Mountain, Colorado, Mount Ashland, Oregon, Snow King, Wyoming, and two that are near and dear to experts: Mount Baker Ski Area in Washington and Silverton Mountain in Colorado.

Under these circumstances, affected resorts might find access roads, trailheads, or utility lines suddenly at the mercy of new owners demanding sky-high easements or renegotiated terms. The closest high-profile example we have of something like this is when POWDR ended up selling Park City to Vail Resorts under less-than-friendly conditions back in 2014—although unlike that time, where POWDR probably would have been able to avoid the situation if they had their paperwork in order, any new resorts facing this circumstance down the line probably won’t be saved by competent back office folks.

In the worst cases, the new land owners could block mountain access entirely, forcing costly operational changes or a hostile takeover or shutdown of the entire resort. Additionally, there’s no guarantee that these new landowners would be conservation or recreation-minded; parcels surrounding ski terrain could be redeveloped into condos or shopping centers, or even industrial sites like timber and mining operations—drastically altering the wilderness aesthetic that many ski resorts hold so dear.

If ski resorts have their land purchased from under them by a third-party, there’s nothing protecting them from a hostile takeover or shutdown.

Environmental and Cultural Impacts

The ramifications of land privatization extend well beyond ski operations themselves. Forest fragmentation caused by piecemeal development increases the risk of wildfire and degrades wildlife habitats, making it theoretically more likely a natural disaster could occur at a resort. The cultural impact is just as significant: ski towns like Jackson Hole, Steamboat, and Breckenridge thrive on their proximity to public lands. Turning these wild zones into high-end condos or commercial strips risks gravely defacing the very outdoor heritage of these communities.

Legal challenges would also become more difficult. The Administrative Procedure Act (APA), which allows citizens to sue over improper government actions, wouldn’t apply to private land transactions unless specific easements or deed restrictions were in place—and nothing in the current bill requires such safeguards. Depending on the state, this could leave concerned stakeholders, local governments, and recreational users with virtually no legal recourse.

Backcountry skiing could be one of the hardest-hit aspects of mountain recreation. Much of the terrain adjacent to ski resorts is currently accessible via Forest Service land, making it the default environment for touring skiers and splitboarders. If these lands are privatized, access could be revoked overnight, and previously popular touring zones could suddenly be off-limits. Skiers and riders crossing these new boundaries could face trespassing charges, effectively criminalizing a form of recreation that has historically been free and open to all.

It’s extremely unlikely that every ski resort will be affected by this bill, but it sets a precedent that could theoretically be acted upon again later.

Counterarguments and Rebuttals

Less Than 1% of Public Lands Will Be Sold

So at this point, you might be revisiting the fact that this bill results in the sale of a relative sliver of public land, meaning the effects we just described are highly unlikely to occur at every resort in the country. However, the precedent it sets is deeply troubling. By creating a fast-track, no-review process for divesting federal land, it establishes a legal and political infrastructure that could easily be expanded. Today’s proposal involves 3 million acres. Future iterations could involve 30 million—or even lands currently protected under monument or park status. Once the actual procedural mechanism for land sales is in place, it’s a lot easier to get it back up and running to push it further.

It’s also worth noting that despite the argument this bill technically only affects a small amount of federal land totaling less than 1% of the footprint, this point overlooks the outsized value of land located near ski resorts, and we wouldn’t be surprised if resort-adjacent land ends up as an excess portion of the acreage sold should the bill go through. In addition, the total area proposed for sale is still astronomically huge, coming in at up to 3.3 million acres; to put this into perspective, this is bigger than the U.S. states of Delaware and Rhode Island combined, more than four times bigger than Yosemite National Park, and over 450 times bigger than Park City, which is the biggest ski resort in the United States. And even beyond the massive extent of this potential land selloff, these parcels are disproportionately important not just for winter sports, but for tourism, conservation, and recreation. Even small changes can have large ripple effects, especially when they alter long-standing access rights or disrupt ecologically sensitive areas. In policy, precedent often matters more than volume, and this bill would set a significant one.

Public Land Sales Will Fix Housing Shortages

Another argument is that the land could be used to alleviate the housing shortage in mountain towns. While housing is undeniably a critical issue, it’s important to highlight that the bill as proposed contains no requirement that the land be used for affordable or workforce housing—let alone the independent analyses that show that so little of this land could actually be practically used for that purpose. Opening these lands to the highest bidder could just as easily result in luxury developments, second homes, or corporate projects—outcomes that could exacerbate housing inequalities rather than solve them—let alone other industrial purposes that are outside the realm of housing entirely. In addition, even if affordable housing is what this land is used for, it could further aggravate the traffic issues to and from many of these ski resorts, especially given that the terrible public transportation circumstances facing many of these towns will force theoretical new residents to use cars.

The Sell-Off Will Bring Government Revenue

A final argument in favor of the land sales is that they would generate revenue for the federal government and help reduce the national deficit. But this is an incredibly shortsighted view that ignores both the long-term economic value of public lands and not-so-economic values Americans enjoy from using them. Outdoor recreation on federal lands—including hiking, hunting, and camping among other things in addition to winter sports themselves—generates billions of dollars in economic activity each year, and is the seeding ground for activities that contribute to the health, happiness, and adventure of Americans and many foreign tourists. Once these lands are sold, all of this risks being disrupted or permanently lost. It’s also worth emphasizing that even if you only consider the economic benefits, these land sales offer only a one-time infusion of cash, while responsible public land management offers continuous, renewable benefits. Selling off public assets to close short-term budget gaps is a fiscally reckless approach more akin to liquidating capital than reducing expenses. One way to put it is it’s like selling your house to pay off a credit card bill: it may bring in quick cash, but the long-term cost far outweighs the immediate gain.

“Valid Existing Rights” Will Protect Permitted Ski Resort Land

There’s also one argument we want to address not necessarily in favor of the bill, but one that claims that ski resort land is safe from the proposed sales. Text has circulated arguing that ski resorts operating on federal land hold “valid existing rights,” a term the bill uses to carve out exceptions. However, the bill lists specific inclusions of what qualifies as a “valid existing right,” and those inclusions are almost entirely focused on extractive industries: mining claims under the Mining Law of 1872, mineral leases under the Mineral Leasing Act, and rights-of-way issued under the Federal Land Policy and Management Act. Notably absent is any mention of recreational Special Use Permits—the exact type of agreement that authorizes ski resorts to operate on Forest Service land—or anything that says that the rights are not limited to the examples listed.

Some may argue that the text of the Special Use Permit itself protects the mountains, stating that:

“This permit is subject to all valid existing rights. Valid existing rights include those derived under mining and mineral leasing laws of the United States.”

However, this doesn’t mean the permit itself is a valid existing right. In fact, it means the opposite: the permit is subject to—or subordinate to—rights held under mining or mineral laws. So while the phrase “valid existing rights” appears in the permit, it does not imply the permit itself qualifies as one under the bill’s legal framework, meaning these ski area lands are very much unprotected from purchase.

While building affordable housing is a respectable cause, there’s no guarantee that the public lands being sold off will be used for this circumstance.

Final Thoughts

The proposed sell-off of public lands threatens to upend the delicate balance between private enterprise and public interest that has defined American skiing and riding, let alone the outdoors as a whole, for nearly a century. While the affected land may seem minuscule to the unassuming observer, the potential consequences are massive: unchecked development, weakened environmental protections, backcountry closures, and a dangerous precedent for future privatization. And while skiing and riding are things that are near and dear to probably everyone who’s watching this channel, many of you are also avid hikers, bikers, climbers, hunters, or fishers too, and this bill has the potential to affect those activities to the same or even bigger extents than the winter sports industry.

If you care about keeping public lands public, now is the time to act. Visit www.congress.gov/members and enter your ZIP code to find your House and Senate representatives. Call their office or send an email—it takes less than five minutes. Here’s a sample script:

“Hi, my name is [Your Name], and I’m a constituent from [Your City]. I’m calling to express my opposition to the proposed public lands sell-off in the Senate budget draft. As someone who values public access to outdoor recreation, including skiing and snowboarding, I believe we need to protect these lands, not privatize them. Please vote against any measure that weakens public land protections.”

The land you ski, hike, and explore belongs to all of us. Let’s keep it that way.

2025 PeakRankings Mountain Score and Rankings Adjustments: Full Changes

As part of the capital investments at dozens of resorts during the 2024-25 season, several mountains have seen significant changes to overall experiences, and we’ve updated our Mountain Scores to highlight that appropriately. Most of these updates reflect real changes in guest experience across […]

Mountain

As part of the capital investments at dozens of resorts during the 2024-25 season, several mountains have seen significant changes to overall experiences, and we’ve updated our Mountain Scores to highlight that appropriately.

Most of these updates reflect real changes in guest experience across dozens of resorts, but in a few cases, we’ve re-calibrated things to better highlight the strengths and weaknesses of certain mountains. In this piece, we’re breaking down all the updates, starting with our 2025 score changes, and then going through how they affect our overall North American ski resort rankings.

Score Adjustments

New lifts improve Powder Mountain’s Challenge, Lifts, and Navigation scores, but new terrain access restrictions hurt Terrain Diversity, Crowd Flow, and Mountain Aesthetic.

Powder Mountain

Lifts Score Change: 2 to 3; Navigation Score Change: 6 to 7; Challenge Score Change: 6 to 7

Crowd Flow Score Change: 10 to 9; Terrain Diversity Score Change: 8 to 7; Mountain Aesthetic Score Change: 7 to 6

Powder Mountain saw an explosive suite of changes this season that, ultimately, led it to have a very similar score to last year’s experience.

Let’s start off with the good. Powder Mountain installed three new lifts this season, adding lift service to the Lightning Ridge area for the first time, replacing the agonizingly long Paradise lift with a high-speed quad, and installing a life-cycle replacement for the Timberline triple, replacing it with a fixed-grip quad. These changes add approximately 430 acres of new lift-served terrain, fix a discontinuity in the lift network by adding a link from the main mountain to the Sundown area for the first time, and make the advanced-oriented Paradise area much more enjoyable to lap. Notably, the Lightning Ridge lift brings the first-ever direct lift service to double-black-diamond terrain at the resort. Viewed as a whole, these changes bring significant improvements in the Lifts, Navigation, and Challenge departments.

However, Powder Mountain paired these upgrades with some extremely controversial policy changes. First off, the resort closed its Mary’s and Village lifts to the public, reserving access to these areas exclusively for Powder Mountain homeowners. In addition, the resort added a new quad lift up the Raintree area, but reserved this lift for private homeowners as well. The paid snowcat up this area has now been discontinued, although guests theoretically can still hike up to it. Despite the upgrades elsewhere around the resort, these terrain restrictions mean that Powder Mountain’s public lift-served footprint is actually a little bit smaller than it was last year. The resort has lost some really nice beginner and intermediate glades as a result of this public acreage shrink, which makes the terrain experience for these abilities slightly less unique than it used to be. There’s also something to be said for the moneyed vibe brought about by closing hundreds of acres of terrain to the public, and the signs for homeowner-only terrain—as well as the literal homeowner patrol standing at some of the private entrances—severely detract from the freeing and down-to-earth vibe that’s historically made the resort so special.

Closing off the Village and Mary’s lifts to the public has also created some potentially unintended consequences. Public guests who visited Powder Mountain this winter may have experienced something almost unheard of in years’ past: lift lines. Now that the Mary’s lift is no longer available, guests have to take the Sunrise surface lift to get anywhere in Cobabe Canyon. This one-person platter turned into somewhat of a chokepoint this past season, even with Powder Mountain’s cap on visitors, and even though lines are extremely rare elsewhere at the resort, we can’t justify keeping the resort at a perfect score for Crowd Flow any longer.

The new Deer Valley East expansion will continue over the next few years, but the first few projects have already improved this fancy Utah resort in a number of ways.

Deer Valley

Navigation Score Change: 5 to 6; Mountain Aesthetic Score Change: 4 to 5

But Powder Mountain wasn’t the only Utah mountain that made significant headlines this winter.

Nearby Deer Valley embarked on the first phase of a massive, multi-year expansion this past winter, and we’d say the biggest benefits actually came in relatively surprising areas. While the 300-acre terrain expansion wasn’t big enough to impact Deer Valley’s size score (the resort will have to wait until next year to see an adjustment in that category), the expanded terrain brought two key advantages over the rest of Deer Valley’s footprint—a full, continuous 3,000-foot vertical drop that doesn’t require a convoluted maze of lifts to get down, and a beautiful and isolated set of surroundings, that, at least so far, is devoid of excess man-made buildup. The new terrain thus far doesn’t bring much in the way of high-quality snow retention or challenge, but we feel that based on the 2024-25 season, it’s actually Deer Valley’s Navigation and Mountain Aesthetic scores that deserve a slight bump.

It remains to be seen whether these scores will remain static for the upcoming winter, as Deer Valley plans to introduce a staggering 2,900 additional acres next winter, and since the expansion was explicitly designed with real estate in mind, the lack of buildup may not last forever.

Big Sky’s new Madison 8 chair improves Crowd Flow in the former Moonlight Basin ski area, complementing previous lift upgrades across the front of this massive ski resort.

Big Sky

Lifts Score Change: 6 to 7; Challenge Score Change: 9 to 10 (with Tram), or 8 to 9 (without Tram)

Big Sky is in the midst of a huge, multi-year transformation, and this year’s upgrades have already brought some substantial improvements to the overall mountain experience. The big change this year was the new Madison 8 lift, which replaced the Six Shooter six-pack as the sole lift connecting the Madison side of the mountain with the rest of the resort.

On the surface, this may seem like a pleasant, if not life-cycle-oriented upgrade. But for those who have experienced the old Six Shooter lift before, they’ll know how much relief it will be to have the new Madison 8 in its place instead. The Madison 8 is already a modern lift in its own right, bringing eight-pack seating, bubbles for weather protection, and heated seats. But the chair also brings a 20% faster ride time than the six-pack, which shaves a full minute off the lengthy ride, and has thus far operated quite reliably in welcome contrast to the issue-prone Six Shooter. Finally, the Madison 8 brings a huge 50% capacity boost over the old lift, providing welcome crowd relief at one of Big Sky’s biggest historical chokepoints. In our view, this upgrade warrants a bump up in the lifts category for Montana’s biggest ski resort.

We’re also making an adjustment to Big Sky’s Challenge score for those who have access to the Lone Peak Tram (which, as of 2025, includes all lift ticket purchasers, select season passholders, and other visitors who choose to purchase a per-ride extra-cost add-on). Runs such as Big Couloir and the Gullies have easily-accessible, extremely high-consequence terrain that may not always involve mandatory straightlines, but requires technical prowess well above nearly every other lift-served ski trail in North America due to the sheer steepness—and consistency of said steepness. We feel this level of high consequence was not adequately captured in our previous score, and accordingly, we are moving Big Sky’s Challenge rating, at least with the Lone Peak Tram, to our highest score of 10. For those who don’t choose to purchase a tram add-on, similarly steep, consistently-long, and high-consequence terrain is available off the Headwaters Hike, and we are moving the non-tram Challenge score to a 9 accordingly.

The upgrade of the Sublette chair to a high-speed quad means that all major mountain areas at Jackson Hole are served by modern detachable chairlifts.

Jackson Hole

Lifts Score Change: 7 to 8; Facilities Score Change: 7 to 8; Resiliency Score Change: 9 to 8

Jackson Hole has gradually been upgrading its oldest lifts over the years, and the Sublette lift’s ascension from a fixed-grip to a high-speed quad might be the last step in that journey. With this installation, guests can lap the high-intermediate-to-expert-oriented Sublette area twice as fast as in years past, with the lift ride up now taking a swift four minutes. One might be surprised to hear that while still a quad, the new lift brings a 33% capacity increase over the outgoing model—although given this lift’s newfound popularity with its higher speed, one might argue that lines actually got slightly longer this year. Now that Sublette has been upgraded, Jackson Hole’s only remaining fixed-grip chairs are located in relatively minor areas or provide redundancy to faster alternatives.

We are also making a few adjustments to Jackson Hole’s mountain score in a few other categories. While we have historically rated the resort exceptionally high on the Resiliency scale, the mountain’s largely east-facing terrain means that fresh snow, while typically quite consistent, tends to deteriorate faster than at competing resorts with north-facing slopes. As a result, we feel that while Jackson Hole is still a generally reliable bet for a ski vacation, a drop in the Resiliency category from 9 to 8 is justified. On the other hand, however, we don’t think we gave Jackson Hole enough credit for its on-mountain facility setup in years past. Upon reflection, we believe that the Bear Flats Snack Shack at the base of the Sublette lift provides a better rest opportunity than we’d given the resort credit for previously. Taking the services here into account gives Jackson Hole a fairly comprehensive lodge setup for most resort areas (although there’s no denying that Bear Flats is not the same full-service restaurant as the Casper or Rendezvous Lodges), and as a result, we are shifting its Facilities score up from a 7 to an 8.

Lake Louise’s new Pipestone Express, the resort’s first-ever bubble lift, improves both lift logistics and facilities access on the front side.

Lake Louise

Lifts Score Change: 6 to 7; Facilities Score Change: 4 to 5

Lake Louise added a new lift this winter that may just seem to add some redundancy on the surface, but in reality brings a number of surprising practical benefits when you actually spend time at the resort. The new Pipestone Express bubble six-pack, which is Lake Louise’s first-ever bubble lift, provides a link from the top of the Juniper Express lift to the bottom of the Summit lift. Pipestone adds a new lift route up Lake Louise’s mid-mountain frontside, supplementing the existing Top of the World six-pack, and finally provides a real purpose for the out-of-base Juniper Express high-speed quad lift, which basically led to nowhere until Pipestone’s installation.

The first two benefits of the new Pipestone lift are obvious. First off, combined with the Juniper lift below it, the Pipestone chair now offers a second redundant lift route to the upper mountain, complementing the Glacier and Top of the World lifts that run to skiers’ left of them, and a third practical lift route out of the main base that leads to desirable terrain (supplementing the Grizzly Gondola). In addition, the new lift’s bubbles provide the first isolation from the elements of any mid-mountain lift at Lake Louise, taking some of the burden off of the gondola on cold days (and Lake Louise can see its fair share of extreme cold spells throughout a typical season).

But the real genius of the Pipestone lift is in its placement. While a mid-mountain lift, the new six-pack is placed low enough on the mountain to solve multiple previous logistical problems. First off, guests can now ski or ride the West Bowl without having to journey all the way back down to the main base to get back up the mountain, meaning that lapping the full vertical of this area only takes two lift rides (Pipestone and Summit), rather than the previous three. Some of the lower trails in the West Bowl are now directly lappable by the Pipestone lift. In addition, those coming from the mid-mountain Whitehorn Bistro restaurant can ski or ride directly to Pipestone rather than making the trek back to the base as well, fixing what was probably the most annoying part about stopping in at that lodge. It may only be one lift, but the Pipestone Express’s logistical benefits justify increases in both Lake Louise’s Lifts and Facilities scores in our view, and while Lake Louise’s existing Crowd Flow score of 8 is probably still justified in our view, the lift brings noticeable benefits in this area as well.

Banff Sunshine Village’s new Super Angel Luxury Express chair has a mouthful of a name, but it makes the crowds at the Teepee Town chair much more digestible on cold or windy days.

Banff Sunshine Village

Crowd Flow Score Change: 6 to 7

Lake Louise’s neighbor, Banff Sunshine Village, also added a new bubble six-pack lift this winter. The Super Angel Luxury Express replaces the old Angel Express high-speed quad, which ran in nearly the same alignment and had reached the end of what the resort considered its useful life. While the new Super Angel lift doesn’t add high-speed lift service in a new area, its addition has significantly improved the experience in the resort’s cold, windy, and highly-exposed upper mountain. If you’re wondering about the term “Luxury Express” this is just the term Banff Sunshine uses to refer to bubble lifts, and until now, the nearby Teepee Town Luxury Express was the only one on the mountain—and as the sole enclosed lift in this above-treeline area, it frequently saw some of the worst crowding at the resort, especially on cold days. With the Super Angel in place, Teepee Town crowding has seen significant relief and traffic between the two bubble lifts has split up nicely, and we’re bumping Banff Sunshine’s Crowd Flow score up accordingly.

After spending more time at Fernie this winter, we’re adjusting its Challenge score to better reflect its extreme terrain.

Fernie

Challenge Score Change: 8 to 9

We’re also bumping Fernie’s Challenge score up from an 8 to a 9 after realizing we hadn’t given the resort enough credit for just how gnarly its terrain can be. While this increase isn’t directly tied to any major new developments—though the resort did make an effort to keep Polar Peak open more consistently this season—it reflects a deeper appreciation for the intensity of what’s already on offer. Even outside of Polar Peak, Fernie features some seriously demanding lines, and the terrain off the peak itself includes marked trails with mandatory straightlines and potential air drops that can be as high as 10 to 20 feet depending on conditions. These lines are only open a handful of days each season, but the fact that they’re on the map speaks volumes.

Alpental’s Internationale chair spreads out crowds trying to reach the upper mountain or backcountry Back Bowls at this advanced-oriented Washington ski area.

Alpental

Crowd Flow Score Change: 3 to 5

This past season, Washington state’s Alpental saw the completion of a project that helped relieve one of the worst chokepoints we’ve ever seen at a North American ski resort. The newly added Internationale triple now offers a crucial secondary route to the upper mountain, which was previously only accessible via the substantially-overburdened Armstrong Express and Edelweiss lift combo. This addition—paired with last year’s installation of the Sessel triple out of the base—finally spreads out the resort’s advanced and expert crowds (which is basically everyone who’s there anyway). While it doesn’t serve every trail that the Armstrong / Edelweiss route does or offer high-speed lift service, the Internationale triple crucially provides an alternative and more direct way to the resort’s backcountry-esque back bowls—and provides a way to lap the resort’s back side without having to ski or ride all the way back to the base. As the closest advanced-oriented ski area to Seattle—and a relatively compact one at that—Alpental still sees weekend lines, but they are nowhere near the horrendous mess of previous years, and we are giving the mountain a substantial two-point Crowd Flow score bump accordingly. It is worth noting that the Edelweiss chair will be upgraded from a double to a triple chair this summer, which should help address some remaining crowd issues in that area.

Mammoth Mountain has historically had frustrating signage across the mountain, but new markings have cleared up many important intersections.

Mammoth

Navigation Score Change: 4 to 5

Next up, we have a resort that’s been putting in behind-the-scenes work to improve wayfinding. Over the past few seasons, Mammoth has quietly overhauled its signage, addressing longstanding issues that made navigating the mountain unnecessarily confusing. The resort has rolled out far more comprehensive maps—including directories to lodges—and redesigned its trail signage, replacing an outdated and often puzzling color-coding system. While not every sign on the mountain has been updated yet, the highest-traffic junctions and lower-mountain areas have seen noticeable improvements. These upgrades make getting around Mammoth easier than it used to be, and we’re bumping the resort’s Navigation score from a 4 to a 5 accordingly.

Utah’s Solitude has faced inconsistent openings in its expert-oriented Honeycomb Canyon zone in recent years, prompting us to lower its Resiliency score by one point.

Solitude

Resiliency Score Change: 8 to 7

Next up, we’re making a score adjustment we were hoping we’d never have to make. When it comes to Utah’s Solitude, the resort has experienced recurring issues with terrain accessibility, particularly in the expert-oriented Honeycomb Canyon, which accounts for a significant portion of the resort’s terrain. Ski patrol has been notably cautious when it comes to opening this zone, and according to the resort, ongoing issues with visitors ducking ropes have further delayed mitigation work. But for whatever the true reason may be, Honeycomb has experienced especially inconsistent and delayed openings over the past two seasons. As a result, the resort often feels much smaller than it appears on paper, with large swaths of terrain remaining closed even during stretches of decent conditions. While Solitude and the other Cottonwood Canyon ski areas often receive some of the best snow on the continent, Solitude’s lower elevation within the canyon leaves it more vulnerable to marginal conditions compared to neighboring Brighton, or nearby Alta and Snowbird. This pattern has become too frequent to ignore—and, notably, is not endemic to most of its Utah competitors—and we’re dropping Solitude’s Resiliency score from an 8 to a 7 as a result.

The Aspen Snowmass region’s newest chairlift, which parallels the line of the out-of-base Village Express for much of its length, eases crowding out of the busy Snowmass Mall base.

Snowmass

Crowd Flow Score Change: 6 to 7

Aspen Snowmass has been making quite a few upgrades over the past couple of years, and this past season, the new Coney Express at Snowmass brought some notable logistical benefits. While in part a life-cycle upgrade—it replaced the aging Coney Glade Express quad as the primary lift for lapping the large terrain park—it also received a major lift line extension down to the Snowmass Mall, which is near the base of the resort. While the new Coney lift doesn’t provide service from the true bottom elevation of Snowmass—it loads a few hundred feet up from the Elk Camp Gondola and the Village Express six-pack—it does capture a huge amount of bus and condo traffic from the Snowmass Mall crowd, providing a much-needed capacity boost out of Snowmass’s main base. The new lift doesn’t serve any new terrain, but the extra throughput has earned the resort a bump from a 6 to a 7 in the Crowd Flow category.

Sun Peaks’ multi-year West Bowl project has brought not only a terrain expansion, but a high-speed lift to its upper mountain for the first time.

Sun Peaks

Lifts Score Change: 5 to 6

This past winter, British Columbia’s Sun Peaks received an upgrade that had been anticipated for over three years. The resort finally replaced its West Bowl T-Bar—which hadn’t operated since 2020—with a new high-speed quad serving not only that same terrain, but providing a small terrain expansion as well. The West Bowl Express finally revitalizes this temporarily-abandoned area with strong intermediate and advanced terrain, and notably, with the nearby Crystal and Burfield lifts being fixed-grip quads, it has also created the first high-speed upper mountain terrain pod on Sun Peaks’ front side. Although the terrain expansion is only 169 acres, the new West Bowl lift makes it much more desirable to spend time in Sun Peaks’ upper mountain—and while guests will still have to ride Crystal or Burfield to get to the West Bowl lift the first time, we’re bumping the resort’s Lifts score from a 5 to a 6 as a result of this upgrade.

New York’s Hunter Mountain will always have crowds, but the recent Broadway Express and Otis Quad chair installations have helped ease the worst congestion.

Hunter

Lifts Score Change: 6 to 7; Crowd Flow Score Change: 2 to 3

New York State’s Hunter Mountain is one of the most crowded ski resorts in the country on peak weekends, but luckily, a handful of upgrades this winter helped address that. First off, the resort replaced its old Broadway quad lift with the Broadway Express high-speed six-pack, adding a second high-speed lift route out of its main base. The resort then took the old Broadway lift and reinstalled it in a new alignment as the Otis Quad, replacing the old, seldom-open E double lift and providing new access to a previously-underutilized low-intermediate terrain pod. It is worth noting that despite Otis’s revitalization, the surface lift directly above the new quad is basically abandoned at this point.

As the closest Epic Pass mountain to New York City, there’s no escaping crowds at Hunter on weekends. But these two new lifts have helped quite a lot. By upgrading Broadway from a quad to a six-pack, the resort saw notable lift line relief on weekends, with crowding becoming at least a bit more manageable. Notably, the Otis Quad remained relatively empty this year, providing guests progressing to intermediate terrain with a new escape from the crowds. In addition, now that the Broadway lift has been upgraded, Hunter guests can now access beginner terrain from a high-speed lift for the first time. The Broadway lift also underwent a realignment, making access to the upper mountain F lift, which provides an alternate way up to the resort summit, much simpler. Hunter will never be a crowd-free experience, but these investments certainly justify upticks in both our Lifts and Crowd Flow categories.

Gore Mountain’s North Creek Ski Bowl area has historically been a bit of an afterthought, but the new Hudson Chair brings high-speed lift service to this area for the first time—and paves the way for this zone to move from weekend-only to seven-day-a-week operations.

Gore

Lifts Score Change: 5 to 6

Finally, we are giving a bump to another ski area with a new high-speed quad lift this year—New York State’s Gore Mountain. In its isolated North Creek Ski Bowl area, the resort replaced its Hudson triple chair with a new high-speed quad. While this area did not operate daily this year, it’s expected to move to a seven-day-a-week cadence next year following base area upgrades this summer. The new lift provides faster service to this low-elevation terrain pod—which might appeal at a first glance to lower-ability skiers and riders but genuinely has some harder terrain—and we’re ticking up Gore’s Lifts score accordingly.

Washington’s Alpental and Utah’s Deer Valley are the two biggest movers in our rankings this season.

Rankings Takeaways

A few notable rankings shifts have occurred with these Mountain Score changes:

-

Two resorts—Deer Valley and Alpental—are tied as this year’s biggest winners, each jumping eight spots compared to 2024. Deer Valley now ranks ahead of several highly competitive Western resorts, including Whitefish, Steamboat, Sun Valley, and Palisades Tahoe. Meanwhile, Alpental leapfrogs a number of strong regional players like Monarch, Willamette Pass, Sunday River, and Dodge Ridge.

-

Other climbers include Mammoth, Sun Peaks, Lake Louise, Fernie, and Gore, each improving by more than one position in our North American standings. On the flip side, Solitude is the only resort to drop more than a single spot this year, falling from 41st to 43rd overall and from 7th to 8th in Utah. And ironically, despite major operational changes, Powder Mountain sees no change at all to its overall score or ranking. Another change worth noting is Big Sky, which climbs from 13th to 12th overall, edging out Alyeska.

-

These changes have also sparked some real shakeups at the top of our rankings:

-

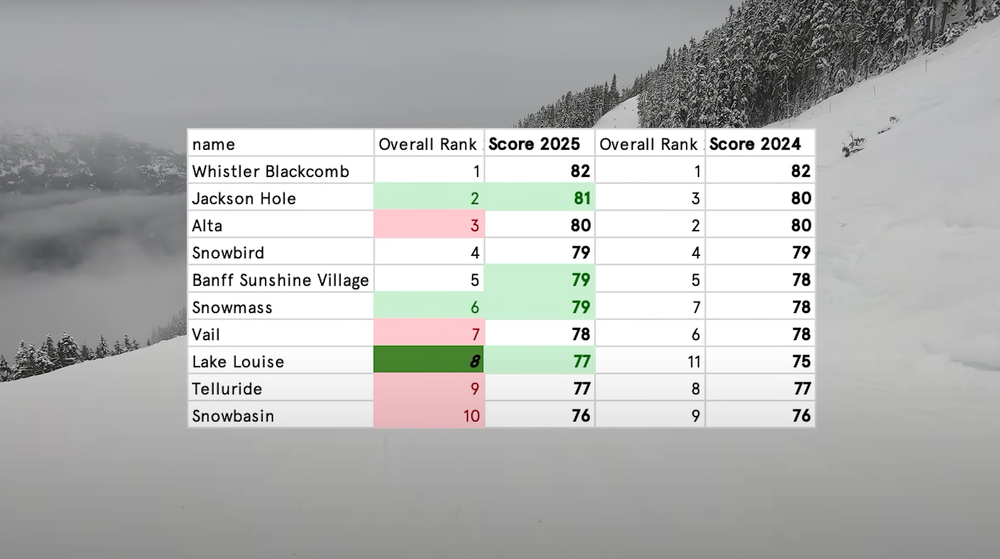

Lake Louise debuts in our top 10 at #8, knocking Telluride, Snowbasin, and Beaver Creek down a spot each (and knocking Beaver Creek out of the top 10 entirely).

-

Just above it, Vail falls one spot to #7, overtaken by Snowmass, which rises to #6 on the back of crowd flow improvements from the new Coney Express. With that shift, Snowmass also claims the title of top-ranked ski resort in Colorado, nudging Vail to second in the state despite its sheer size.

-

Despite the increased competition from Snowmass, Banff Sunshine holds its rank at #5. The new Super Angel lift has significantly improved flow, which pairs with the resort’s stunning footprint and terrain variety to deliver a remarkably strong experience.

-

But the runner-up slot this year now goes to Jackson Hole, swapping places with Alta (neighboring Snowbird remains at #4). Thanks to all of its infrastructure improvements over the past few years, the Wyoming resort now gets our second place spot in North America, and our #1 slot for the United States overall.

-

Our top peak in North America remains Whistler Blackcomb. However, the Mountain Score gap between Whistler and Jackson Hole is now just a single point, marking the first time Whistler Blackcomb has not had a multi-point score advantage over its nearest North American competitor. Depending on what happens next season, we could be looking at the first time in PeakRankings history that Whistler Blackcomb doesn’t claim the crown.

-

What do you think of these rankings? Anything you would change or disagree with? Let us know in the comments below.

Our updated list of the Top 10 ski areas in North America includes the addition of Lake Louise, while Jackson Hole and Snowmass have climbed the ranks as well. The 2024 rankings are provided on the right-hand side for reference.

Rob Katz Back As Vail Resorts CEO

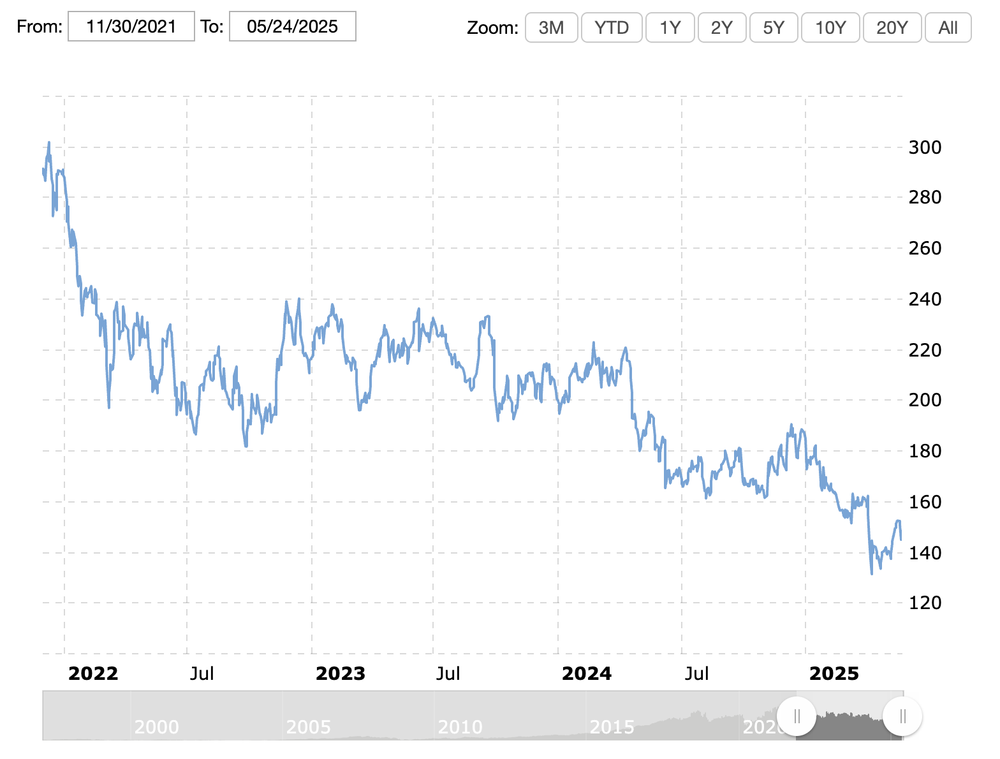

Rob Katz returns as Vail Resorts CEO after serving previously from 2006 to 2021. In a significant leadership shift, Vail Resorts announced today that Rob Katz, its former CEO and current Executive Chairperson, will return to the CEO role. Katz replaces Kirsten Lynch, […]

Mountain

Rob Katz returns as Vail Resorts CEO after serving previously from 2006 to 2021.